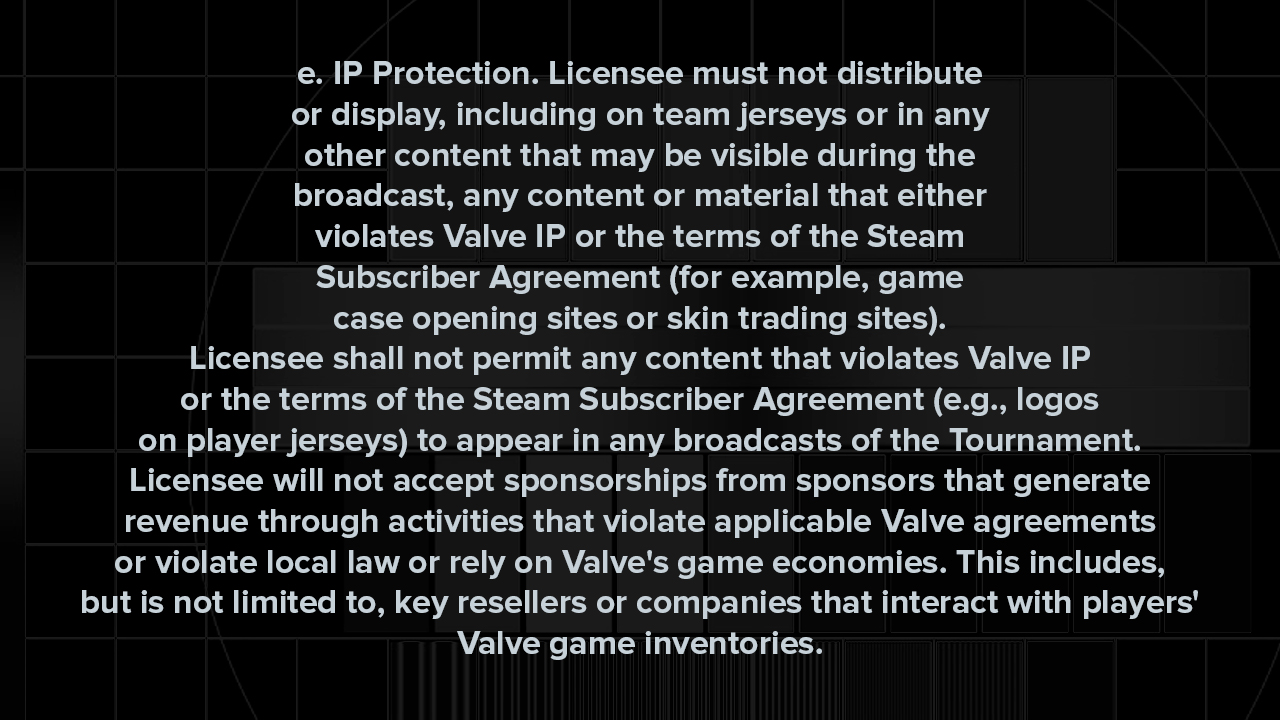

Valve has introduced a significant update to its Counter-Strike 2 Tournament Operating Requirements and Limited Game Tournament License. The new language, centered on “IP Protection,” restricts which sponsors teams and tournament organisers may display on jerseys, broadcasts, and other official materials. The rule specifically prohibits sponsorships from websites or companies that violate Valve’s intellectual property, the Steam Subscriber Agreement, or rely directly on Valve’s ingame item economy.

This change has been widely discussed within the Counter-Strike community because it affects a category of sponsors that has been deeply integrated into the esports landscape for years. While the update is straightforward in its text, the implications for organisations, especially those outside the top tier, are substantial. This article outlines what the rule states, why it matters, and how it may influence team budgets, player salaries, and the broader competitive structure.

Understanding the new rule

The updated “IP Protection” clause states that licensees may not distribute or display any content during broadcasts that violates Valve IP or the Steam Subscriber Agreement. It provides examples such as case opening websites and skintrading platforms. It also specifies that organisers and teams may not accept sponsorships from businesses whose revenue models violate Valve agreements, local law, or rely directly on Valve’s game economy systems. This includes key resellers and companies that interact with player inventories.

The restriction applies to jerseys, physical event signage, broadcast overlays, promotional materials, and any on-stream content. In practice, it removes a category of sponsorships previously common in Counter-Strike: services built around skins and case openings.

This update affects both ranked and unranked Valve-licensed events, meaning that the rule reaches across the entire structure of official competitive play. Tournament operators and teams must ensure that prohibited logos do not appear in any broadcast-visible areas.

Why this change matters

Sponsorships tied to CS2’s skin economy have been visible in esports for more than a decade. They frequently appeared on team jerseys, interview backdrops, video content, and tournament staging. For many organisations, especially those outside the top tier, these sponsors provided consistent financial support.

The new Valve restrictions therefore address an established revenue stream. Although the rule does not target traditional gambling sponsors, hardware brands, consumer goods, or other commercial sectors, it removes partnerships connected to item trading and case opening economies. For organisations that leaned on these sponsors as a primary or secondary funding source, the adjustment represents a notable shift.

read more

Teams participating in the 2025 StarLadder Budapest Major, for example, were already observed removing apparel logos associated with these services, indicating that the rule was being implemented quickly.

Financial impact on organisations

The first and most direct effect of the rule concerns team finances. Major organisations typically diversify their partnerships across several industries, including hardware, apparel, consumer technology, energy drinks, and conventional betting companies that do not rely on the in-game item economy. As a result, the rule may have limited financial impact on the largest and most established brands. While some may need to adjust jersey designs or restructure sponsor placement, their overall funding stability is less likely to be affected.

For mid-tier and emerging organisations, the situation is different. Skin-related platforms have historically been one of the more accessible sponsorship categories for teams operating outside the top tier. These organisations often lack the global reach or competitive achievements needed to attract long-term partnerships in more traditional commercial sectors. As a result, the prohibition removes one of the few reliable revenue sources available to them.

read more

Teams in this position may need to pursue alternative sponsors, reduce operational budgets, or adjust salary structures. While not every team will be affected in the same way, the financial landscape for Tier 2 and Tier 3 organisations may change significantly as they search for partners that comply with the new requirements.

Potential effects on player salaries

Player salaries are one of the largest recurring expenses for any esports organisation. When an organisation loses a primary sponsor, the financial shortfall often leads to practical adjustments. These may include renegotiated contracts, reduced monthly salaries, or shorter-term commitments. Some teams may choose to shift to mixed fulltime and part time player models, or rely more heavily on academy level contracts.

In top tier Counter-Strike, salaries are supported by stable commercial partnerships, sticker revenue from Valve-sponsored events, and stronger merchandise sales. The removal of item-economy sponsors is unlikely to meaningfully change salary expectations for elite players.

The effects are more pronounced in the tiers below. Many players in smaller organisations rely on modest but consistent salaries that allow them to practice full-time. If teams decide to reduce expenditure or pause expansion plans, players may face a more uncertain financial environment. In extreme cases, teams may withdraw from competitive play or scale down operations until new partners are secured.

read more

Tournament operators and broadcast compliance

Tournament operators must now ensure that the updated rules are applied consistently across all broadcast visible channels. This includes team jerseys, video content, presentation graphics, analyst desk overlays, and in arena signing areas. Events must also audit sponsored segments to ensure compliance with Valve’s IP and the Steam Subscriber Agreement.

For organisers, this may require additional review processes and communication with teams ahead of events. It also means that event level partnerships cannot include businesses tied to the ingame item economy. Similar restrictions have existed at some Valve sponsored events in the past, but this update formalises and standardises the rule across all licensed competitions.

In practical terms, viewers may notice fewer skin-related advertisements and fewer of these logos on uniforms at upcoming events.

Broader implications for the competitive ecosystem

The long-term effects of this rule will depend on how quickly organisations can secure alternative partners. Some may transition toward more conventional sponsor categories. Others may attempt to expand content output or merchandise sales to compensate for lost revenue.

For Tier 2 and regional teams, the challenge is more difficult. The esports industry remains highly competitive, and most commercial partners prioritise teams with large audiences or strong international visibility. Without the previously available item-economy sponsorships, smaller organisations might face a period of financial adjustment.

read more

However, the rule also introduces a clearer and more predictable sponsorship framework. Organisations now have a definitive understanding of which categories are permitted, which may help them target long-term partnerships with fewer uncertainties.

What comes next?

Valve’s new sponsorship restrictions represent a meaningful shift in how teams and tournament organisers may present themselves in Counter-Strike 2 esports. The prohibition on displaying or accepting sponsorships from companies tied to item trading, case opening, or other activities related to Valve’s ingame economy affects teams differently depending on their size and financial structure.

Top-tier organisations are likely to adapt quickly, while smaller teams may face a more challenging transition as they adjust budgets or search for new partners. Player salaries at the lower levels of competition may be influenced as teams rebalance expenses.

As the competitive scene continues to adapt, the full impact of the rule will become clearer. What is certain is that the sponsorship landscape in Counter-Strike esports has entered a new phase, and teams across all tiers will be adjusting to a more defined and regulated commercial environment.